This Week in Business: Reflecting on the Year in Games

This Week in Business is our weekly recap column, a collection of stats and quotes from recent stories presented with a dash of opinion (sometimes more than a dash) and intended to shed light on various trends. Check every Friday for a new entry.

The Year That Was: A Rollercoaster Ride for the Games Industry

The end of the year is looming ahead, and it’s time for us to look back and reflect on the rollercoaster ride that the games industry has experienced. With the burst of the pandemic bubble, rampant layoffs, collapsing events, and the closure of beloved studios, it’s easy to label the year as horrible. But amidst the chaos, there were also some incredible games released that captivated players worldwide.

However, before we jump to conclusions, let’s put the conventional wisdom to the test. Last year, we examined the sales charts to determine whether 2022 was truly a terrible year for new games. Surprisingly, our analysis revealed that 2022 was considerably better than the previous two years, and on par with the pre-pandemic era.

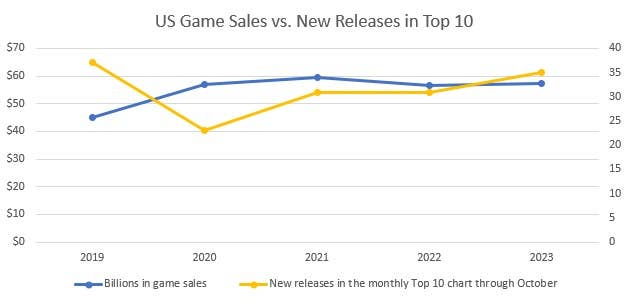

Now, let’s fast forward to 2023. Circana (formerly NPD) recently released its October US monthly sales consumer spending report, providing us with the data we need to analyze how this year’s game lineup compares to previous years.

A Promising Start: Strong Numbers for New Game Releases

In the first ten months of the year, 35 new games made it to the top 10 charts, surpassing the average of 32.3 seen in the previous years. This places 2023 in the company of other successful years, such as 2016 and 2019.

But the real test lies in the top 20 charts. In this category, 47 new games secured a spot, exceeding the average of 40.4 in the past years. This impressive number demonstrates that 2023 has delivered a robust lineup of new games, second only to 2018’s peak.

Despite these impressive numbers, there is a discrepancy when it comes to sales figures. US consumer spending on games has only shown a 1% year-over-year growth through October. This raises the question: Why aren’t the sales figures reflecting the abundance of top-selling new releases?

Digging Deeper: The Relationship Between Game Quality and Sales

One possible explanation lies in the quality of the games themselves. Axios recently conducted a study, counting the number of new releases with a Metacritic average of 90 or higher on at least one platform each year since 2004. Their findings showed that 2023 has seen the highest number of critically acclaimed games in 20 years, with 25 games meeting the 90+ average threshold.

When comparing these critically acclaimed games to US game sales, we find a strong correlation. This suggests that the quality of new releases may play a significant role in driving sales figures.

However, it’s important to note that the game industry’s landscape is complex, and there are likely multiple factors at play. The nature of consumer spending, the economy, and other external forces all contribute to the ebb and flow of the industry’s fortunes.

The Complex Puzzle of Game Industry Data

One of the challenges in analyzing the game industry’s performance is the lack of comprehensive and consistent data. The NPD’s reporting has undergone significant changes over the years, with the inclusion of digital sales, mobile games, and other subscription-based revenue. However, the data provided by the NPD may not capture the full picture due to the varying methodologies employed by different publishers and platforms.

Moreover, the relationship between game sales and overall consumer spend remains elusive. While the number of best-selling games doesn’t always align with sales figures, it’s important to consider the wider economic context. The games industry operates within a dynamic market influenced by various factors beyond individual game releases.

As the games industry continues to grow, tracking and reporting accurate data becomes increasingly challenging. Companies guard their data closely, and the industry’s expanding landscape makes it difficult to create a standardized measurement for industry performance.

The Year in Review: Notable News and Quotes

STAT: 78 – The number of consecutive months Mario Kart 8 Deluxe appeared in the NPD/Circana Top 20 sales chart since its debut in April 2017, but this streak ended in October.

STAT: 0.6% – Newzoo lowered its full-year games industry forecast for 2023 to a 0.6% increase, down from the previously projected 2.6% growth in August.

QUOTE: “The people that love Brisbane and love the scene in Brisbane really want to keep vitalizing the scene. That’s why I want to stay in Brisbane. I don’t want to leave my community behind and we all want to be able to encourage other people coming into Brisbane, growing, and being a part of the community here.” – Witch Beam producer Mei-Li C. emphasizes the importance of nurturing the local game development scene.

For more coverage of the Australian games industry, explore our Australia Games Week coverage featuring various studios and their achievements.

QUOTE: “We’ve worked for many publishers and platform owners over the years and just felt like it was time for us to take on an ownership model and do things our way.” – 3rd-Phase Boss managing editor Stephen Farrelly explains the motivation behind starting a worker-owned media company.

STAT: 7 – NetEase has launched its seventh new studio this year, further expanding its presence in the industry.

QUOTE: “It’s kind of like a snake that gets bigger and then regurgitates, gets bigger and then regurgitates, and just goes back and forth. It’s been that cycle forever. And I don’t see that changing. That’s just human nature meets capitalism and a combination of long-term and short-term planning from larger companies.” – Industry veteran Jordan Weisman shares insights into the cycles of growth and contraction in the games industry.

Stay up to date with the industry by checking out our coverage of the recent layoffs, restructuring, and developments.

QUOTE: “We’ve listened to our customers, and we know delivering free games every month is what they want most, so we are refining our Prime benefit to increase our focus there.” – Amazon Games VP Christoph Hartmann explains the company’s decision to lay off 180 employees, emphasizing their dedication to providing free games to customers.

QUOTE: “As the single largest transaction in the video games industry, Microsoft’s $68.7 billion acquisition of Activision Blizzard means 2023 is greater than the last two years of M&As combined!” – DDM highlights the magnitude of Microsoft’s acquisition of Activision Blizzard.

QUOTE: “What I noticed is, when I was paying for the therapist, a lot of what the therapist was telling me was, ‘You gotta get out of this situation.’ But when they hired the therapist, every other thing was comparable except there was never a recommendation for me to leave. And when I hinted at it, they were like, ‘No, you can make it work. That’s just one solution but it’s not the best one, you’ll find the same problems elsewhere.'” – Osama Dorias discusses the industry’s approach to burnout and highlights the need for employee-focused resources.

As we wrap up another eventful year in the games industry, it’s clear that tracking its performance requires careful analysis and consideration. While the relationship between game quality, sales figures, and overall industry health might not be straightforward, the industry’s growth and the passion of its players and developers continue to shape its future.

Stay tuned for next week’s entry, where we’ll continue to delve into the ever-evolving landscape of the games industry.